Term life insurance quotes provide a crucial starting point for individuals looking to secure their financial future. This comprehensive guide dives deep into the intricacies of term life insurance, shedding light on key aspects that influence decision-making and coverage options.

As we unravel the layers of term life insurance quotes, readers will gain valuable insights into the factors that impact quotes, how to interpret them effectively, and why comparing multiple quotes is essential for finding the right coverage.

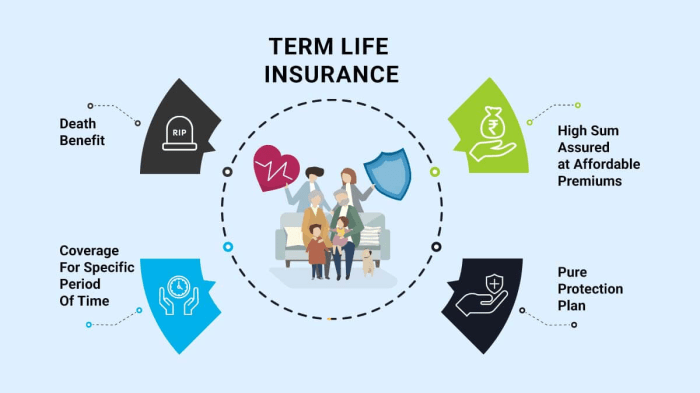

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers financial protection to your beneficiaries in the event of your death during the term of the policy.Key Features of Term Life Insurance:

- Premiums are typically lower compared to other types of life insurance.

- Coverage is for a specified term only, after which the policy expires.

- It does not have a cash value component like whole life insurance.

- Benefits are paid out to the beneficiaries if the policyholder passes away during the term.

Differentiation from Other Types of Life Insurance:

- Term life insurance is more affordable than whole life insurance.

- Unlike universal life insurance, term life insurance does not have an investment component.

- Whole life insurance provides coverage for the entire lifetime of the insured, while term life insurance has a specific term.

Importance of Term Life Insurance Quotes

When it comes to securing your family's financial future, getting term life insurance quotes is a crucial step in the decision-making process. These quotes provide valuable insights into the cost and coverage options available, helping you make an informed choice that aligns with your needs and budget.

Why Getting Term Life Insurance Quotes is Essential

Term life insurance quotes give you a clear understanding of the premiums you would have to pay for a specific coverage amount over a set period. By comparing quotes from different insurance providers, you can identify the most cost-effective option that offers the necessary protection for your loved ones.

How Term Life Insurance Quotes Help in Decision-Making

- Allows for Budget Planning: By obtaining term life insurance quotes, you can assess how much you need to allocate towards premiums without straining your finances.

- Customized Coverage: Quotes help you tailor your policy to suit your family's unique needs, whether it's providing for children's education or paying off a mortgage.

- Comparing Options: With multiple quotes in hand, you can compare coverage features, exclusions, and rider options to select a policy that offers the best value.

Significance of Comparing Multiple Term Life Insurance Quotes

Comparing multiple term life insurance quotes is essential to ensure that you are not only getting the best price but also the most comprehensive coverage for your circumstances. Each insurance provider may have different underwriting criteria and pricing structures, so exploring various options can help you find the most suitable policy at a competitive rate.

Factors Influencing Term Life Insurance Quotes

When it comes to determining term life insurance quotes, several factors come into play that can significantly impact the cost of coverage. Factors such as age, health, coverage amount, and term length play a crucial role in shaping the quotes individuals receive from insurance providers.

Age and Health

Age and health are two of the most critical factors that influence term life insurance quotes. Younger individuals typically receive lower quotes as they are considered lower risk by insurance companies. On the other hand, older individuals may face higher premiums due to an increased likelihood of health issues.

Similarly, individuals with pre-existing medical conditions may also receive higher quotes as they pose a higher risk to insurers.

Coverage Amount and Term Length

The coverage amount and term length chosen by individuals also impact term life insurance quotes. A higher coverage amount will naturally result in higher premiums, as the insurance company is taking on a greater financial risk. Moreover, the length of the term selected for the policy will also affect the cost of insurance.

Longer terms generally come with higher premiums compared to shorter terms, as the insurer is providing coverage for a more extended period

Obtaining Term Life Insurance Quotes

When it comes to obtaining term life insurance quotes, the process can be relatively straightforward if you know what to do. Here are some steps and tips to help you navigate the process efficiently.

Requesting Term Life Insurance Quotes

- Start by researching reputable insurance companies that offer term life insurance.

- Visit their websites or contact them directly to request quotes.

- Provide accurate information about your age, health, lifestyle, and coverage needs to get an accurate quote.

Comparing Term Life Insurance Quotes

- Once you receive quotes from different insurers, compare them based on coverage amount, premiums, policy terms, and any additional benefits offered.

- Consider the financial strength and reputation of the insurance company before making a decision.

- Look for any hidden fees or exclusions that may affect the overall value of the policy.

Tips for Obtaining Accurate Quotes

- Be honest about your health and lifestyle habits to avoid discrepancies in the future.

- Ask for quotes for different coverage amounts to see how it impacts the premiums.

- Consider working with an independent insurance agent who can help you compare quotes from multiple companies.

- Review the fine print of the policy to understand any limitations or restrictions that may apply.

Interpreting Term Life Insurance Quotes

When it comes to understanding term life insurance quotes, it's essential to know how to read and interpret the information provided. Term life insurance quotes contain crucial details that can help you make an informed decision about your coverage. Let's delve into the components of a term life insurance quote and how to analyze them effectively.

Components of a Term Life Insurance Quote

- The Coverage Amount: This is the amount of money that will be paid out to your beneficiaries in the event of your death.

- The Term Length: This refers to the length of time the policy will be in effect, typically ranging from 10 to 30 years.

- The Premium: This is the amount you will pay for the policy, usually on a monthly or annual basis.

- Rider Options: Riders are additional provisions that can be added to your policy for extra coverage, such as accelerated death benefits or a waiver of premium.

Analyzing and Interpreting Term Life Insurance Quotes

- Compare Multiple Quotes: Obtain quotes from different insurance companies to compare coverage amounts, term lengths, and premiums to find the best option for your needs.

- Consider Your Financial Situation: Evaluate how much coverage you need based on your financial obligations, such as mortgage payments, education expenses, and future income needs.

- Understand Policy Exclusions: Pay attention to any exclusions or limitations in the policy that may affect the coverage, such as suicide clauses or risky activities.

- Seek Clarification: If you have any doubts or questions about the terms of the policy, don't hesitate to ask the insurance provider for clarification to ensure you fully understand the coverage.

Benefits of Comparing Term Life Insurance Quotes

When it comes to purchasing term life insurance, comparing multiple quotes can offer several advantages. By taking the time to compare different options, individuals can find affordable coverage that meets their specific needs. This process can also lead to better coverage options and potential savings in the long run.

Advantages of Comparing Multiple Quotes:

- Allows for a comprehensive review of available options

- Helps in understanding the range of premiums and coverage offered by different insurers

- Enables individuals to tailor their policy to their unique requirements

How Comparing Quotes Can Help in Finding Affordable Coverage:

- Identifying cost-effective policies within budget constraints

- Highlighting opportunities for discounts or special offers

- Ensuring that individuals are not overpaying for unnecessary coverage

How Comparing Quotes Can Lead to Better Coverage Options and Savings:

- Allows for a side-by-side comparison of policy features and benefits

- Facilitates the selection of a policy with adequate coverage for specific needs

- Opens up possibilities for cost savings through competitive pricing

Ending Remarks

In conclusion, understanding term life insurance quotes is not just about numbers; it's about securing peace of mind and financial stability for you and your loved ones. By delving into the nuances of this crucial financial tool, individuals can make informed decisions that pave the way for a more secure future.

Question & Answer Hub

What factors typically influence term life insurance quotes?

Factors such as age, health status, coverage amount, and term length can all impact term life insurance quotes.

How can I effectively compare multiple term life insurance quotes?

It's essential to request quotes from multiple providers, review the coverage details, and consider the premiums and benefits offered before making a decision.

Why is it important to understand and interpret term life insurance quotes accurately?

Understanding the components of a quote can help individuals choose the most suitable coverage based on their needs and budget.