Exploring the realm of general liability insurance, this introduction aims to captivate readers with a comprehensive yet engaging overview of the topic. It delves into the fundamental aspects of coverage, risks, and financial protection provided by this essential insurance policy.

As we unravel the intricacies of general liability insurance, we aim to provide a clear and informative narrative that sheds light on its significance in the business world.

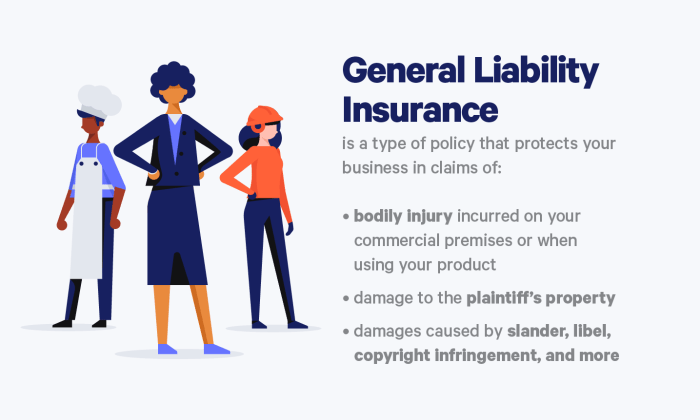

Definition of General Liability Insurance

General liability insurance is a type of insurance policy designed to protect businesses from financial losses resulting from claims of injury or damage caused to others by their operations, products, or employees. It provides coverage for legal costs, medical expenses, and damages awarded in lawsuits.

Types of Coverage Included in General Liability Insurance

- Bodily Injury Coverage: This type of coverage helps pay for medical expenses and legal fees if someone is injured on your business premises or as a result of your business operations.

- Property Damage Coverage: Property damage coverage helps pay for repairs or replacement of property that your business is held responsible for damaging.

- Personal and Advertising Injury Coverage: This coverage protects against claims of libel, slander, copyright infringement, and other similar offenses.

- Medical Payments Coverage: Medical payments coverage helps pay for medical expenses if someone is injured on your business premises, regardless of who is at fault.

Examples of Situations Where General Liability Insurance Would Come into Play

- If a customer slips and falls in your store, sustaining injuries, general liability insurance would cover their medical expenses and any legal fees if they decide to sue your business.

- If one of your employees accidentally damages a client's property while on a job, general liability insurance would cover the costs of repairing or replacing the damaged property.

- In the event that your business is sued for defamation due to an advertising campaign, personal and advertising injury coverage would help cover legal fees and damages awarded in a lawsuit.

Importance of General Liability Insurance

General liability insurance is essential for businesses of all sizes and industries to protect themselves from unexpected events that could lead to financial loss.

Risk Mitigation

- General liability insurance helps mitigate risks such as third-party bodily injury or property damage claims. For example, if a customer slips and falls in your store, this insurance can cover their medical expenses and your legal fees.

- It also protects your business from advertising injury claims, such as slander or copyright infringement, which could result in costly lawsuits.

- Product liability coverage is another key aspect of general liability insurance, shielding your business from claims related to faulty products causing harm to consumers.

Financial Protection

General liability insurance provides financial protection by covering legal expenses, settlements, and judgments in the event of a covered claim. Without this insurance, businesses may face significant out-of-pocket costs that could threaten their financial stability.

Coverage Limits and Exclusions

General liability insurance policies come with specific coverage limits and exclusions to protect businesses from financial risks. Understanding these limits and exclusions is crucial for businesses to assess their insurance needs accurately.

Coverage Limits

- General liability insurance policies typically have per-occurrence limits, which cap the amount the insurer will pay for a single claim or incident. This limit can range from $1 million to $5 million, depending on the policy.

- Aggregate limits are another common feature, setting a maximum amount the insurer will pay for all claims during the policy period. This limit is usually higher than the per-occurrence limit.

- It's essential for businesses to carefully evaluate their liability risks and choose coverage limits that adequately protect their assets and operations.

Exclusions

- General liability insurance typically does not cover intentional acts or damages caused intentionally by the insured party.

- Professional liability, product defects, and employee injuries are often excluded from general liability policies and may require additional coverage.

- Claims arising from pollution, cyber attacks, and employee disputes may also be excluded from general liability insurance.

Claims Exceeding Coverage Limits

- In cases where a claim exceeds the coverage limits of a general liability policy, the insured business may be responsible for paying the remaining costs out of pocket.

- For example, if a customer slips and falls on business premises, resulting in a severe injury and a lawsuit that exceeds the per-occurrence limit, the business may have to cover the excess amount.

- Businesses should consider purchasing excess or umbrella liability insurance to provide additional coverage beyond the limits of their general liability policy.

Cost Factors and Considerations

When it comes to general liability insurance, the cost can vary depending on several factors that influence the premiums. Understanding these factors is crucial for businesses to make informed decisions about their insurance coverage.

Factors Influencing Cost

- The industry in which the business operates: Certain industries are considered to have higher risks, leading to higher premiums.

- Business size and revenue: Larger businesses with higher revenue may face higher premiums due to increased exposure to liability risks.

- Location of the business: Businesses located in areas prone to natural disasters or with higher crime rates may face higher premiums.

- Claims history: A history of frequent or costly claims can lead to higher premiums as it indicates higher risk.

Comparison for Small Businesses vs Large Corporations

- Small businesses typically pay lower premiums compared to large corporations due to their smaller scale of operations and lower revenue.

- Large corporations, on the other hand, may have higher premiums due to their extensive operations and exposure to potentially larger liability risks.

Tips to Lower Premiums

- Implement risk management strategies: Proactively managing risks within the business can help lower the likelihood of claims, leading to potential premium reductions.

- Review and update coverage regularly: Ensuring that the insurance coverage aligns with the current needs of the business can prevent overpaying for unnecessary coverage.

- Shop around and compare quotes: Getting quotes from multiple insurance providers can help businesses find the best coverage at competitive rates.

Closing Summary

In conclusion, general liability insurance stands as a crucial shield for businesses, offering protection against unforeseen circumstances and potential financial burdens. By understanding its coverage limits, cost factors, and importance, businesses can navigate the complex landscape of risk management with confidence.

Answers to Common Questions

What does general liability insurance cover?

General liability insurance typically covers third-party bodily injuries, property damage, advertising mistakes, and legal expenses related to covered claims.

Is professional liability insurance the same as general liability insurance?

No, professional liability insurance focuses on claims related to professional services rendered, while general liability insurance covers a broader range of risks such as bodily injury and property damage.

Can I lower my general liability insurance premiums?

Businesses can often lower their premiums by implementing risk management strategies, maintaining a good claims history, and bundling policies with the same insurer.