Embark on a journey to discover the world of cheap full coverage insurance. From understanding what it entails to finding the best deals, this guide has everything you need to know to secure comprehensive coverage without breaking the bank.

Delve into the nuances of insurance costs, factors affecting premiums, and the risks associated with opting for the cheapest options. By the end of this read, you'll be equipped with the knowledge to make informed decisions about your insurance needs.

Understanding Full Coverage Insurance

Full coverage insurance typically includes both liability coverage and comprehensive/collision coverage. Liability coverage helps pay for damages and injuries you cause to others, while comprehensive/collision coverage helps pay for damages to your own vehicle, regardless of fault.

Benefits of Having Full Coverage Insurance

Having full coverage insurance provides peace of mind knowing that you are financially protected in various situations. Some benefits include:

- Protection against damages from accidents, theft, vandalism, or natural disasters.

- Coverage for medical expenses for you and your passengers in case of an accident.

- Financial assistance for repair or replacement of your vehicle.

Examples of Situations Where Full Coverage Insurance is Essential

Full coverage insurance is essential in scenarios such as:

- Being involved in a multi-vehicle accident where you are at fault and need to cover damages to other vehicles and injuries to other drivers.

- Hitting a deer on the road and needing repairs for your car due to the collision.

- Having your car stolen and needing assistance with the replacement or recovery process.

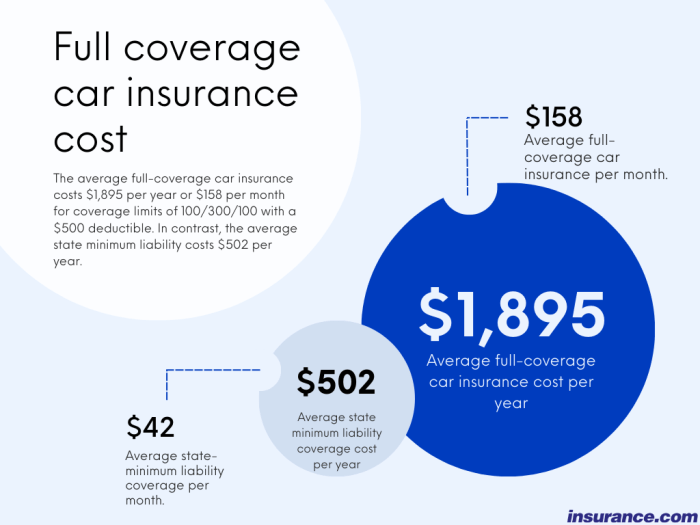

Factors Affecting the Cost of Full Coverage Insurance

When it comes to determining the cost of full coverage insurance, several factors come into play. These factors can vary from one individual to another, impacting the overall premium amount.

Type of Vehicle

The type of vehicle you drive plays a significant role in determining the cost of full coverage insurance. Generally, more expensive or high-performance vehicles will have higher insurance premiums compared to standard or less costly vehicles. This is because expensive cars are more costly to repair or replace in case of an accident, leading to higher premiums.

Personal Driving History

Another crucial factor that affects the cost of full coverage insurance is your personal driving history. Insurance companies take into account your driving record, including any past accidents, traffic violations, or claims you have made. A clean driving record with no accidents or violations will typically result in lower insurance premiums, as it indicates a lower risk of accidents in the future.

Tips for Finding Cheap Full Coverage Insurance

When looking for cheap full coverage insurance, there are several strategies you can implement to lower the cost of your premiums

Additionally, bundling policies can also help reduce insurance expenses significantly.

Comparing Quotes

When comparing quotes from different insurance providers, make sure to consider the coverage options, deductibles, and any discounts offered. By doing a thorough comparison, you can find a policy that offers the right balance between coverage and affordability.

Bundling Policies

Bundling policies, such as combining your auto and home insurance, can often lead to substantial discounts on your premiums. Insurance companies usually offer discounts to customers who purchase multiple policies from them, making bundling a cost-effective option for reducing overall insurance expenses.

Risks of Opting for Cheap Full Coverage Insurance

When it comes to choosing full coverage insurance, opting for the cheapest option may seem appealing at first due to the lower premium. However, there are significant risks associated with selecting a policy solely based on cost without considering the coverage provided.

Inadequate Coverage

One of the primary drawbacks of choosing cheap full coverage insurance is the potential for inadequate coverage. These policies often come with higher deductibles, lower coverage limits, and exclusions that may leave you vulnerable in case of an accident or other unforeseen events.

- Low coverage limits may not be sufficient to cover the full cost of damages or medical expenses.

- High deductibles mean you'll have to pay more out of pocket before your insurance kicks in, which can be financially burdensome.

- Exclusions in the policy may leave certain types of damage or incidents uncovered, leading to unexpected expenses.

Importance of Balancing Cost and Coverage

It's essential to strike a balance between cost and coverage when selecting full coverage insurance. While it's tempting to opt for the cheapest option to save money in the short term, inadequate coverage can end up costing you more in the long run.

Remember, the true value of insurance lies in providing financial protection and peace of mind when you need it most. Cutting corners on coverage to save a few dollars upfront can leave you exposed to significant risks and financial hardship.

Summary

In conclusion, cheap full coverage insurance offers an enticing option for those seeking comprehensive protection at an affordable price. Remember to balance cost and coverage, explore different strategies for savings, and always compare quotes to find the best deal. With this knowledge in hand, you're ready to navigate the world of insurance with confidence and financial savvy.

Query Resolution

What does full coverage insurance include?

Full coverage insurance typically includes liability, collision, and comprehensive coverage to protect you in various situations.

How can I find cheap full coverage insurance?

You can find affordable full coverage insurance by comparing quotes, bundling policies, and exploring discounts offered by different providers.

What are the risks of opting for the cheapest full coverage insurance?

Choosing the cheapest option may lead to inadequate coverage, higher deductibles, or limitations in your policy that could leave you vulnerable in certain situations.