Exploring the world of business car insurance is crucial for companies looking to protect their assets and employees on the road. From understanding the differences between personal and business coverage to selecting the right insurance type, this guide will provide valuable insights for businesses of all sizes.

Overview of Business Car Insurance

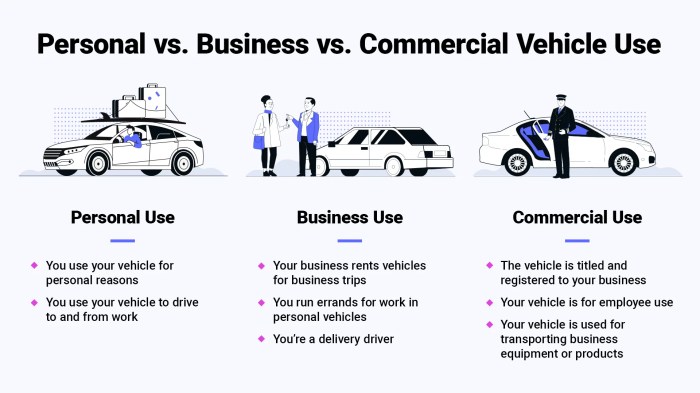

Business car insurance is a type of insurance coverage that provides financial protection for vehicles used for business purposes. It is essential for companies that rely on vehicles for their operations, as it helps mitigate the risks associated with accidents, theft, or damage to these vehicles.Key Differences:Unlike personal car insurance, business car insurance typically covers multiple drivers and vehicles under one policy.

It also offers higher liability limits to protect the company from potential lawsuits in case of accidents involving the business vehicles.Examples of Businesses:

1. Delivery Services

Companies that provide delivery services rely heavily on their fleet of vehicles to transport goods. Business car insurance helps protect these vehicles and ensure smooth operations.

2. Construction Companies

Construction companies often use trucks and other vehicles to transport equipment and materials to job sites. Having the right insurance coverage is crucial to safeguard these assets.

3. Real Estate Agencies

Real estate agents frequently use their vehicles to show properties to clients. Business car insurance can provide coverage in case of accidents during property visits.

Types of Business Car Insurance

When it comes to insuring vehicles for business purposes, there are several types of business car insurance to consider. Each type offers different coverage options tailored to specific needs and circumstances.

Commercial Auto Insurance

- Commercial auto insurance is designed for vehicles used primarily for business purposes, such as delivery trucks, company cars, or service vehicles.

- This type of insurance typically covers liability for bodily injury and property damage, as well as comprehensive and collision coverage for the vehicle itself.

- Commercial auto insurance may also include coverage for uninsured or underinsured motorists, medical payments, and roadside assistance.

Hired and Non-Owned Auto Insurance

- Hired and non-owned auto insurance provides coverage for vehicles that are not owned by the business but used for business purposes, such as rental cars or employee-owned vehicles used for work.

- This type of insurance typically covers liability for bodily injury and property damage, as well as medical payments and uninsured motorist coverage.

- Hired and non-owned auto insurance may also include coverage for legal expenses related to accidents involving these vehicles.

Factors Influencing Insurance Selection

- The type of business and industry it operates in will greatly influence the choice of business car insurance.

- The number of vehicles owned or used by the business, as well as the frequency and distance of travel, will also impact the coverage needed.

- The driving records of employees who will be operating the vehicles, as well as the value of the vehicles themselves, are important factors to consider when selecting the right insurance type.

Cost Factors and Considerations

When it comes to business car insurance, there are several key factors that determine the cost of coverage. These factors can vary depending on the size and type of business, as well as other considerations. Understanding these factors and implementing strategies to manage and reduce insurance premiums can help businesses save money and protect their assets.

Factors Affecting Insurance Costs

- The driving record of employees: Insurance companies will assess the driving records of employees who will be using the company vehicles. A history of accidents or traffic violations can lead to higher premiums.

- Type of vehicles: The type of vehicles being insured will also impact the cost. Luxury or high-performance cars will generally cost more to insure than standard vehicles.

- Usage of vehicles: The frequency and purpose of vehicle use will be taken into account. Vehicles used for business purposes may have higher insurance premiums compared to personal use vehicles.

- Location: The location where the vehicles will be driven and parked can affect insurance costs. Areas with higher rates of accidents or theft may have higher premiums.

Impact of Business Size and Type

- Smaller businesses may have lower insurance premiums compared to larger corporations, as they typically have fewer vehicles to insure.

- The type of business can also impact insurance costs. For example, a delivery service may have higher premiums due to the increased risk of accidents associated with frequent driving.

Strategies to Reduce Insurance Premiums

- Implement driver training programs: Providing training for employees on safe driving practices can help reduce accidents and lower insurance premiums.

- Choose vehicles wisely: Opting for vehicles with safety features and lower repair costs can result in lower insurance premiums.

- Consider a higher deductible: Increasing the deductible amount can lower premiums, but businesses should ensure they can afford the out-of-pocket costs in case of a claim.

- Shop around: Comparing quotes from multiple insurance providers can help businesses find the best coverage at competitive rates.

Legal Requirements and Compliance

Businesses have specific legal requirements when it comes to car insurance to ensure compliance with regulations and protect themselves from potential risks.

Legal Requirements for Businesses

Businesses are required to have a minimum level of car insurance coverage to legally operate their vehicles. The specific requirements may vary depending on the state or country where the business is located.

- Liability Insurance: Businesses are typically required to have liability insurance to cover damages and injuries caused to others in an accident where the business is at fault.

- Uninsured/Underinsured Motorist Coverage: Some jurisdictions also require businesses to have coverage for accidents involving uninsured or underinsured motorists.

- Personal Injury Protection (PIP) or Medical Payments Coverage: In certain states, businesses may need to provide coverage for medical expenses resulting from car accidents, regardless of fault.

Consequences of Non-Compliance

Failure to comply with the legal requirements for car insurance can have serious consequences for businesses, including:

- Fines and Penalties: Businesses that do not have the required insurance coverage may face fines, penalties, or even legal action.

- Lack of Protection: Without proper insurance coverage, businesses leave themselves vulnerable to financial losses in the event of an accident.

- Loss of Business License: In some cases, non-compliance with insurance regulations can result in the suspension or revocation of a business license.

Tips for Ensuring Compliance

To ensure that a business meets all legal obligations related to car insurance, consider the following tips:

- Regularly Review Policies: Businesses should review their insurance policies regularly to ensure they meet current legal requirements.

- Work with an Insurance Professional: Consulting with an insurance professional can help businesses understand their insurance needs and ensure compliance with regulations.

- Keep Records Up-to-Date: Businesses should keep accurate records of their insurance policies and coverage levels to provide proof of compliance if needed.

Claims Process and Coverage

When it comes to business car insurance, understanding the claims process and coverage is crucial for ensuring that your business is protected in case of unexpected events on the road.

Filing a Claim

When filing a claim for business car insurance, the process typically involves contacting your insurance provider as soon as possible after an incident occurs. You will need to provide details about the incident, such as the date, time, location, and any other relevant information.

Common Scenarios

- Accidents involving company vehicles

- Theft or vandalism of business vehicles

- Damaged caused by natural disasters

These are some common scenarios where businesses may need to use their insurance coverage to cover the costs of repairs or replacements.

Coverage Limits and Deductibles

It's important to understand how coverage limits and deductibles can impact the claims process. Coverage limits refer to the maximum amount your insurance provider will pay for a covered claim, while deductibles are the out-of-pocket expenses you must pay before your insurance kicks in.

For example, if your coverage limit is $50,000 and your deductible is $1,000, you would be responsible for paying the first $1,000 of any covered claim, and your insurance provider would cover the remaining $49,000.

Insurance Providers and Comparison

When it comes to selecting an insurance provider for your business car insurance, there are several key factors to consider. It's essential to compare different insurance companies offering business car insurance to ensure you are getting the best coverage for your needs.

Additionally, reviewing and updating your insurance policies regularly is crucial to make sure you are adequately protected at all times.

Key Factors to Consider When Choosing an Insurance Provider

- Financial Stability: Ensure the insurance provider is financially stable and able to pay out claims when needed.

- Coverage Options: Look for a provider that offers the specific coverage options you require for your business vehicles.

- Customer Service: Consider the insurer's reputation for customer service and how they handle claims.

- Pricing: Compare quotes from different providers to find a competitive rate for your business car insurance.

Comparison of Different Insurance Companies

- Company A: Offers a wide range of coverage options tailored for businesses with fleets of vehicles.

- Company B: Known for excellent customer service and quick claims processing for business car insurance.

- Company C: Provides competitive pricing and discounts for businesses insuring multiple vehicles.

Importance of Reviewing and Updating Insurance Policies Regularly

- Changes in Business Needs: As your business grows or changes, your insurance needs may also evolve.

- New Coverage Options: Insurance providers may introduce new coverage options that could benefit your business.

- Regulatory Updates: Stay informed about any changes in regulations that may affect your insurance requirements.

Summary

In conclusion, navigating the realm of business car insurance requires careful consideration and informed decision-making. By understanding the various types of coverage, cost factors, legal requirements, and claims processes, businesses can ensure they are adequately protected in case of unforeseen events.

Stay informed and make the best choices for your company's insurance needs.

FAQ Compilation

Do I need business car insurance if I use my personal vehicle for work purposes?

Yes, if you use your personal vehicle for business purposes, you will likely need business car insurance to ensure proper coverage.

What factors influence the cost of business car insurance?

The cost of business car insurance is influenced by factors such as the size of the business, type of vehicles being insured, driving history of employees, and coverage limits selected.

What are the consequences of not complying with legal requirements for car insurance?

Non-compliance with legal requirements for car insurance can result in fines, penalties, and even the suspension of business operations in severe cases.