Delve into the world of home owner insurance to discover the protection it offers for your most valuable asset - your home. From understanding different coverage options to navigating the claims process, this guide will equip you with the knowledge needed to make informed decisions about your insurance needs.

Importance of Home Owner Insurance

Home owner insurance is a crucial investment for any homeowner, providing protection and peace of mind in the face of unexpected events.

Having home owner insurance safeguards your investment in your property, ensuring that you are financially protected in case of damage or loss due to various factors.

Protection Against Natural Disasters

- Home owner insurance can cover damages caused by natural disasters such as hurricanes, wildfires, or earthquakes, mitigating the financial impact on homeowners.

- In the event of a natural disaster, having insurance can help you rebuild or repair your home without facing significant financial burden.

Liability Coverage

- Home owner insurance also provides liability coverage, protecting you in case someone is injured on your property and decides to sue you.

- This coverage can help with legal fees and potential settlements, giving you added security and protection.

Theft and Vandalism Protection

- If your home is broken into or vandalized, home owner insurance can help cover the cost of replacing stolen items or repairing damages, easing the financial strain on you.

- This protection ensures that you are not left to deal with the consequences of theft or vandalism on your own.

Types of Coverage

When it comes to home owner insurance, there are various types of coverage available to protect your investment and belongings. Each type of coverage serves a specific purpose and provides financial security in different scenarios.

1. Dwelling Coverage

Dwelling coverage protects the physical structure of your home in case of damage from covered perils such as fire, wind, hail, or vandalism. It typically includes coverage for the foundation, walls, roof, and built-in appliances.

2. Personal Property Coverage

Personal property coverage helps replace or repair personal belongings inside your home that are damaged or stolen. This includes furniture, clothing, electronics, and other items. It's important to document your belongings to ensure accurate coverage.

3. Liability Coverage

Liability coverage protects you financially if someone is injured on your property or if you accidentally damage someone else's property. This coverage can help cover legal fees, medical expenses, and settlement costs.

4. Additional Living Expenses Coverage

Additional living expenses coverage provides reimbursement for temporary living arrangements if your home becomes uninhabitable due to a covered loss. This can include hotel stays, meals, and other necessary expenses.

5. Medical Payments Coverage

Medical payments coverage helps pay for medical expenses if a guest is injured on your property, regardless of who is at fault. This coverage can help avoid lawsuits and provide peace of mind.

6. Other Structures Coverage

Other structures coverage protects detached structures on your property such as garages, sheds, or fences. It helps cover repair or replacement costs if these structures are damaged by covered perils.

7. Loss of Use Coverage

Loss of use coverage reimburses you for additional living expenses if you are unable to live in your home due to a covered loss. This can include rent, hotel stays, and other necessary costs.

8. Scheduled Personal Property Coverage

Scheduled personal property coverage allows you to insure high-value items such as jewelry, art, or collectibles separately. This ensures these items are adequately covered in case of loss or damage.

9. Flood Insurance

Flood insurance is a separate policy that covers damages caused by flooding, which is not typically included in standard home owner insurance policies. It is important to assess the risk of flooding in your area and consider adding this coverage if necessary.

Factors Affecting Premiums

When it comes to home owner insurance premiums, there are various factors that can influence the cost of coverage. Understanding these factors is crucial in managing your insurance expenses effectively.

Location of Your Home

The location of your home plays a significant role in determining your insurance rates. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered high-risk and may attract higher premiums. Additionally, the crime rate in your neighborhood can also impact the cost of your insurance.

- Living in a region with a high frequency of natural disasters can lead to increased premiums.

- Areas with a higher crime rate may result in higher insurance costs.

- Proximity to a fire station or hydrant can positively impact your premiums.

Insurance companies assess the risk associated with the location of your home to determine the premium you will pay.

Tips to Lower Your Premiums

There are steps you can take to potentially lower your home owner insurance premiums:

- Increasing your home security with alarms, deadbolts, and smoke detectors can reduce the risk of theft and damage, leading to lower premiums.

- Bundling your home and auto insurance with the same provider often results in discounts.

- Regularly reviewing and updating your policy to ensure you are not paying for coverage you no longer need.

- Improving your credit score can also help lower your premiums as insurance companies may view you as a lower risk.

Filing a Claim

When it comes to filing a home owner insurance claim, it is important to understand the process and what documentation is typically required. Navigating the claims process smoothly can help you get the compensation you need in a timely manner.

Process of Filing a Claim

- Contact your insurance company as soon as possible after the incident occurs to start the claims process.

- Provide all necessary details about the damage or loss, including when and how it happened.

- An insurance adjuster may visit your property to assess the damage and determine the extent of coverage.

- Submit any required documentation, such as a police report, photos of the damage, and receipts for repairs or replacements.

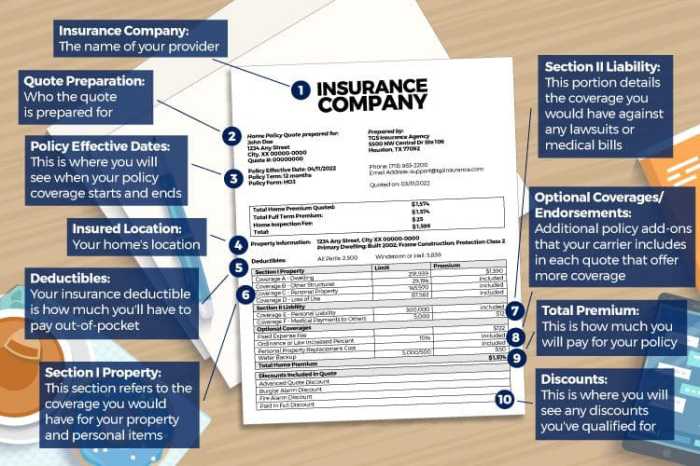

Documentation Required

- Policy information: Have your policy number and details ready when filing a claim.

- Proof of loss: Document the damage with photos or videos to support your claim.

- Receipts and estimates: Keep all receipts and estimates for repairs or replacements.

- Police report: If the damage is due to theft or vandalism, a police report may be required.

Tips for Navigating Claims Process

- Keep records: Maintain a file with all communication, receipts, and documents related to your claim.

- Be proactive: Follow up with your insurance company regularly to ensure the process is moving forward.

- Understand your policy: Familiarize yourself with what is covered and any limits or exclusions in your policy.

- Work with professionals: Consider hiring a public adjuster to help with the claims process if needed.

Coverage Limits and Deductibles

When it comes to home owner insurance, coverage limits and deductibles play a crucial role in determining the extent of protection you have for your property. Understanding these factors is essential to ensure you have the right level of coverage in place.Coverage limits refer to the maximum amount your insurance policy will pay out for a covered loss.

This limit can vary depending on the type of coverage you have and the specific terms Artikeld in your policy. It is important to review your coverage limits regularly to make sure they align with the current value of your property.Deductibles, on the other hand, are the amount you are responsible for paying out of pocket before your insurance kicks in to cover the rest of the claim.

Typically, the higher the deductible you choose, the lower your premium will be. However, it's crucial to select a deductible that you can afford in the event of a claim.

How Coverage Limits and Deductibles Affect Your Policy

- Higher coverage limits provide more protection but may result in higher premiums.

- Lower deductibles mean you pay less out of pocket, but your premiums may be higher.

- Choosing the right balance between coverage limits and deductibles is key to finding the most cost-effective policy.

Additional Coverages

When it comes to protecting your home, standard insurance policies may not always cover every possible scenario. That's where additional coverages come in, providing extra protection for specific risks that may not be included in your basic policy.

Flood Insurance

One important optional coverage to consider is flood insurance. Standard home insurance policies typically do not cover damages caused by floods, so having a separate flood insurance policy can help protect your home and belongings in case of a flood event.

Personal Property Coverage

Another beneficial add-on is personal property coverage. This type of coverage can help replace or repair your personal belongings, such as furniture, electronics, and clothing, in the event of theft, damage, or loss due to covered perils.

Enhanced Liability Protection

Enhancing your liability protection is another way to boost your coverage. Increasing your liability limits can provide additional financial protection in case someone is injured on your property and decides to sue you for damages.

Final Wrap-Up

As we wrap up our exploration of home owner insurance, remember that safeguarding your home is not just a choice, but a crucial investment in your future. With the right coverage and understanding of the process, you can rest assured that your home is protected against the uncertainties of tomorrow.

FAQs

What does home owner insurance typically cover?

Home owner insurance usually covers the structure of your home, personal belongings, liability protection, and additional living expenses in case of a covered event like a fire or theft.

How can I lower my home owner insurance premiums?

You can potentially lower your premiums by increasing your deductible, bundling your home and auto insurance, improving home security measures, and maintaining a good credit score.

Do I need additional coverages like flood insurance?

If you live in a flood-prone area, it's advisable to consider adding flood insurance as a separate coverage since standard home owner insurance policies usually do not cover flood damage.

How does the location of my home affect insurance rates?

The location of your home plays a significant role in determining insurance rates, especially if you live in areas prone to natural disasters or high crime rates, which can lead to higher premiums.

What is the claims process like for home owner insurance?

When filing a claim, you'll typically need to provide documentation such as a police report (for theft), estimates for repairs, and any other relevant information related to the incident. It's important to communicate promptly with your insurance company to ensure a smooth process.