Delve into the realm of affordable insurance companies as we uncover essential factors, types of coverage, strategies for savings, and the pros and cons. This guide is designed to provide valuable insights for those seeking budget-friendly insurance options.

The subsequent section will offer detailed information on various aspects related to cheap insurance companies.

Factors to Consider When Looking for Cheap Insurance Companies

When searching for affordable insurance companies, there are several key factors to keep in mind to ensure you get the best coverage at the lowest cost. It's important to compare different quotes, understand how the type of coverage you choose affects the premium, and implement strategies to lower your overall costs.

The Importance of Comparing Different Quotes

Comparing quotes from multiple insurance companies allows you to identify the best rates available in the market. By obtaining quotes from various providers, you can easily compare coverage options, deductibles, and premiums to find the most cost-effective policy that meets your needs.

- Request quotes from at least three different insurance companies to get a comprehensive overview of available options.

- Consider reaching out to independent agents who can provide quotes from multiple carriers to help you find the best deal.

- Review each quote carefully and ensure that you understand the coverage details and any exclusions before making a decision.

How the Type of Coverage Affects the Cost

The type and amount of coverage you choose significantly impact the cost of your insurance premiums. Understanding the relationship between coverage options and premiums can help you make informed decisions to keep your costs low while still ensuring adequate protection.

- Opt for a higher deductible to lower your premium, but be prepared to pay more out of pocket in the event of a claim.

- Consider bundling multiple policies, such as auto and home insurance, with the same provider to qualify for discounts.

- Review your coverage limits and adjust them based on your needs to avoid overpaying for unnecessary protection.

Tips on How to Lower Premiums

In addition to comparing quotes and understanding coverage options, there are several strategies you can use to lower your insurance premiums further.

- Maintain a clean driving record and good credit score to qualify for lower rates.

- Take advantage of discounts offered by insurance companies for factors like safe driving, bundling policies, and installing safety devices.

- Consider raising your credit score as a higher credit rating can lead to lower insurance premiums.

Types of Insurance Offered by Affordable Companies

When looking for affordable insurance companies, it is important to consider the types of insurance they offer. Here are some common types of insurance provided by affordable companies:

Auto Insurance

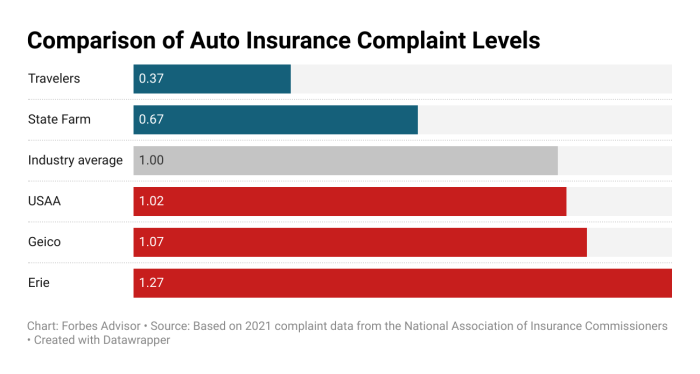

Auto insurance typically covers damages and liabilities related to your vehicle. This can include coverage for accidents, theft, vandalism, and other related incidents. The pricing of auto insurance can vary depending on factors such as your driving record, the type of vehicle you own, and your location.

Home Insurance

Home insurance provides coverage for damages to your home and personal belongings. This can include protection against fire, theft, natural disasters, and other unforeseen events. The cost of home insurance is influenced by factors like the value of your home, its location, and the coverage limits you choose.

Health Insurance

Health insurance offers coverage for medical expenses and healthcare services. This can include doctor visits, hospital stays, prescription medications, and other medical treatments. The pricing of health insurance depends on factors such as your age, overall health, and the type of coverage you select.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. This can include a lump sum payment or regular income to beneficiaries. The cost of life insurance is determined by factors like your age, health status, and the coverage amount.

Business Insurance

Business insurance offers protection for businesses against financial losses and liabilities. This can include coverage for property damage, legal claims, and other risks specific to business operations. The pricing of business insurance is based on factors such as the type of business, its size, and the level of coverage needed.

Pricing Comparison

When comparing the pricing of different insurance types, it is important to consider the coverage provided and the specific needs of your situation. While some types of insurance may have higher premiums, they may also offer more comprehensive coverage

Strategies to Find Affordable Insurance Companies

When it comes to finding affordable insurance companies, there are several strategies that can help you save money on your premiums. Whether you're looking for health insurance, auto insurance, or any other type of coverage, these tips can help you secure the best rates possible.

Leveraging Discounts

One of the most effective ways to lower your insurance costs is by taking advantage of discounts offered by insurance companies. These discounts can vary depending on the insurer, but common ones include discounts for safe driving, bundling multiple policies, being a loyal customer, or having a good credit score.

Be sure to ask about all available discounts when shopping for insurance.

Role of Deductible in Lowering Costs

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can significantly lower your insurance premiums. While this means you'll have to pay more in the event of a claim, it can help you save money in the long run by reducing your monthly payments.

Just make sure you can afford the deductible amount if you ever need to make a claim.

Tips for Bundling Insurances to Save Money

Bundling your insurance policies, such as combining your auto and home insurance with the same company, can lead to significant savings. Insurance companies often offer discounts to customers who purchase multiple policies from them. Not only does bundling save you money, but it can also make managing your insurance coverage more convenient by having all your policies in one place.

Pros and Cons of Choosing Cheap Insurance Companies

Choosing a cheap insurance company can have its advantages and disadvantages. While affordable premiums may be appealing, there are certain trade-offs to consider when opting for budget-friendly coverage.

Benefits of Choosing Affordable Insurance

- Lower Premiums: One of the most significant advantages of cheap insurance companies is the cost-saving aspect. Individuals on a tight budget can benefit from reduced premiums, allowing them to meet their financial obligations.

- Basic Coverage: Affordable insurance companies often offer essential coverage options that can provide a level of protection against unforeseen events without breaking the bank.

- Accessibility: Cheap insurance companies may be more accessible to individuals who have difficulty affording traditional insurance policies, ensuring that more people can receive some form of coverage.

Potential Drawbacks or Limitations

- Limited Coverage: Cheap insurance companies may provide limited coverage options, leaving policyholders vulnerable to certain risks that are not included in their policy.

- Subpar Customer Service: In some cases, inexpensive insurance providers may offer subpar customer service, leading to frustration when filing claims or seeking assistance.

- Quality Concerns: The affordability of insurance premiums can sometimes be reflective of the quality of coverage provided. Cheaper policies may have more restrictions or higher deductibles, impacting the overall value of the insurance.

Examples of How Quality Can Vary with Cost

For instance, a low-cost auto insurance policy may offer minimal coverage limits and higher deductibles, which could result in higher out-of-pocket expenses in the event of an accident. On the other hand, a more expensive policy might provide comprehensive coverage with lower deductibles, offering greater peace of mind but at a higher price.

Ultimate Conclusion

In conclusion, navigating the realm of cheap insurance companies requires a careful balance of cost and coverage. By understanding the intricacies involved, individuals can make informed decisions to secure the most suitable insurance at an affordable price point.

Answers to Common Questions

What factors should be considered when looking for cheap insurance companies?

When looking for cheap insurance companies, it's crucial to compare quotes, consider the type of coverage needed, and explore ways to lower premiums.

What types of insurance are typically offered by affordable companies?

Affordable insurance companies usually offer various types of insurance such as auto, home, and health insurance. Each type provides specific coverage tailored to individual needs.

How can one find affordable insurance companies?

To find affordable insurance companies, individuals can leverage discounts, understand the role of deductibles in cost reduction, and consider bundling insurances to save money.

What are the pros and cons of choosing cheap insurance companies?

Choosing cheap insurance companies can offer cost savings, but it may come with limitations in coverage quality. It's essential to weigh the benefits against the potential drawbacks.