Decoding Cheap Car Insurance Quotes: A Comprehensive Guide

Exploring the realm of cheap car insurance quotes, this introduction sets the stage for a detailed exploration of key factors, strategies, comparisons, and coverage options. Providing valuable insights in a casual formal language style that aims to inform and engage readers from the outset.

As we delve deeper, we will uncover the intricacies of obtaining affordable car insurance and navigating the various considerations that influence insurance costs.

Factors Influencing Cheap Car Insurance Quotes

When it comes to obtaining affordable car insurance quotes, there are several key factors that insurance companies take into consideration. These factors can vary from the make and model of the vehicle to the driver's age and location. Understanding these factors can help individuals make informed decisions when looking for the best insurance rates.

Vehicle Make, Model, and Age

The type of vehicle you drive plays a significant role in determining your car insurance rates. Insurance companies consider the make, model, and age of the vehicle when calculating premiums. Generally, newer and more expensive cars will have higher insurance costs due to the increased cost of repairs or replacements.

On the other hand, older and more affordable vehicles may result in lower insurance premiums.

Driver’s Age, Driving Record, and Location

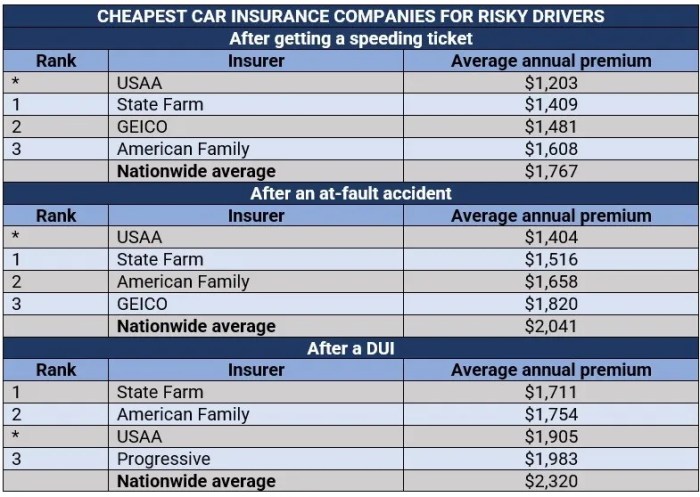

The driver's age, driving record, and location also impact car insurance quotes. Younger drivers, especially teenagers, typically face higher insurance rates due to their lack of driving experience and higher risk of accidents. Additionally, drivers with a history of traffic violations or accidents may be considered high-risk and receive higher premiums.

Moreover, the location where the vehicle is primarily parked or driven can influence insurance costs, with urban areas often associated with higher rates compared to rural areas.

Strategies to Obtain Cheap Car Insurance Quotes

When it comes to getting affordable car insurance quotes, there are several strategies you can implement to lower your premiums and secure a better deal. These strategies range from bundling policies to opting for usage-based insurance programs. Let's explore some of the most effective ways to obtain cheap car insurance quotes.

Bundling Policies

- Consider bundling your car insurance policy with other insurance products, such as home or renter's insurance, from the same provider. This often leads to discounted rates known as multi-policy discounts.

- By bundling your policies, you can save money on each individual insurance product and reduce your overall insurance costs significantly.

Importance of Credit Score

- Maintaining a good credit score can have a significant impact on your car insurance rates. Insurers often use credit scores to determine the risk profile of a policyholder, with higher credit scores typically leading to lower premiums.

- Make sure to monitor your credit score regularly, pay bills on time, and keep your credit utilization low to improve your credit score and secure cheaper car insurance quotes.

Usage-Based Insurance

- Usage-based insurance programs, also known as telematics programs, track your driving behavior using a device installed in your car or a mobile app. Insurers then adjust your premiums based on your driving habits.

- Safe drivers who participate in usage-based insurance programs can benefit from lower premiums, as their rates are determined by their actual driving performance rather than general demographic factors.

Comparison of Different Insurance Companies

When looking for cheap car insurance quotes, it is essential to compare quotes from various insurance providers to find the most cost-effective option. This process involves analyzing not only the price but also other factors such as customer service, coverage options, and financial stability of the insurance company.

By considering these aspects, you can make an informed decision and choose the best insurance provider for your needs

Importance of Customer Service

Customer service plays a crucial role in the overall experience of dealing with an insurance company. A company that provides excellent customer service can offer quick assistance and support in case of any issues or claims. When comparing insurance companies, consider reading reviews and asking for recommendations to assess the level of customer service offered by each provider.

Coverage Options and Financial Stability

Apart from price, it is important to evaluate the coverage options offered by different insurance companies. Ensure that the coverage meets your specific needs and requirements. Additionally, consider the financial stability of the insurance company to ensure that they can fulfill their financial obligations in case of claims.

Look for ratings from independent agencies to gauge the financial strength of the insurer.

Leveraging Discounts and Promotions

Many insurance companies offer discounts and promotions to attract customers. It is advisable to inquire about any available discounts or promotions that you may qualify for. Common discounts include multi-policy discounts, safe driver discounts, and discounts for anti-theft devices. By leveraging these discounts, you can lower your insurance premium and obtain a more affordable quote.

Understanding Coverage Options for Cheap Car Insurance

When it comes to cheap car insurance, understanding the different coverage options available is crucial. The types of coverage you choose can significantly impact the affordability of your insurance quotes. Let's delve into the various coverage options and how they can influence your premiums.

Types of Coverage

- Liability Insurance: This coverage helps pay for injuries and property damage that you may cause to others in an accident.

- Comprehensive Insurance: Provides coverage for damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Collision Insurance: Covers damage to your car resulting from a collision with another vehicle or object.

Choosing the Right Coverage Limits

- Opting for higher coverage limits can provide you with better financial protection but may also lead to higher premiums.

- On the other hand, selecting lower coverage limits can make your insurance more affordable but could leave you financially vulnerable in case of a severe accident.

Optional Coverages and Their Influence on Premiums

- Roadside Assistance: This optional coverage can help you out in case of a breakdown, flat tire, or running out of gas. Adding this coverage may increase your premiums slightly.

- Rental Car Reimbursement: If your car is in the shop for repairs after an accident, this coverage can help cover the cost of a rental car. Including this coverage could impact your premiums.

Final Review

In conclusion, this discussion has shed light on the complexities of securing cheap car insurance quotes. By understanding the factors at play, implementing effective strategies, and comparing options diligently, individuals can make informed decisions to protect their vehicles and finances.

FAQ Explained

What factors affect the cost of cheap car insurance quotes?

Insurance companies consider factors like vehicle make, model, driver's age, driving record, and location.

How can I lower my insurance premiums?

You can lower premiums by bundling policies, increasing deductibles, and maintaining a good credit score.

Why is it important to compare quotes from different insurance companies?

Comparing quotes helps in finding the most cost-effective option based on customer service, coverage, and financial stability.

What are the types of coverage options available for cheap car insurance?

Coverage options include liability, comprehensive, collision insurance, with optional coverages like roadside assistance or rental car reimbursement.

Does usage-based insurance offer cost-saving benefits?

Usage-based insurance can provide cost-saving benefits by tailoring premiums based on actual driving behavior.