Ensuring Your Homes Safety: A Guide to Homeowners Insurance

As one of the most important investments in your life, your home deserves to be protected. Homeowners insurance plays a crucial role in safeguarding your property and providing peace of mind. Let's delve into the world of homeowners insurance to understand why it's essential and how it can benefit you.

When unexpected events occur, having the right coverage can make all the difference in ensuring financial security for you and your family.

Importance of Homeowners Insurance

Homeowners insurance is essential for protecting your home from unexpected events that could result in significant financial loss. It provides peace of mind knowing that you have a safety net in place to help you recover from disasters.

Situations where homeowners insurance can provide financial security

- Damage to your home due to natural disasters such as hurricanes, earthquakes, or wildfires

- Theft or vandalism resulting in property loss

- Liability coverage in case someone is injured on your property

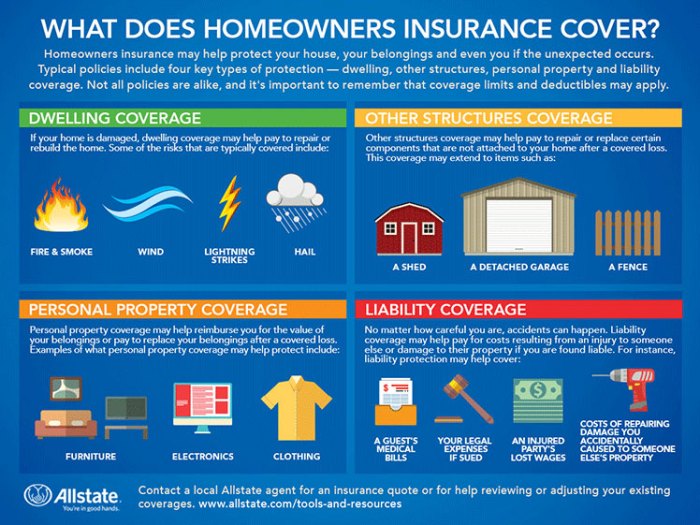

Types of coverage typically included in a standard homeowners insurance policy

- Property coverage for your home and personal belongings

- Liability coverage for legal expenses if someone is injured on your property

- Additional living expenses coverage if you need to temporarily relocate due to damage to your home

Benefits of having homeowners insurance versus not having it

- Financial protection: Homeowners insurance can help cover the costs of repairing or rebuilding your home after a disaster.

- Peace of mind: Knowing that you have insurance in place can reduce stress and worry about potential risks.

- Lender requirement: If you have a mortgage, your lender will likely require you to have homeowners insurance to protect their investment.

Factors Affecting Homeowners Insurance Premiums

When it comes to determining homeowners insurance premiums, insurance companies take into account various factors that can impact the cost of coverage. Understanding these factors can help homeowners make informed decisions to potentially lower their insurance premiums.

Location of the Home

The location of a home plays a significant role in determining insurance premiums. Homes located in areas prone to natural disasters such as floods, hurricanes, or earthquakes may have higher premiums due to increased risk. Additionally, the proximity to a fire station and the crime rate in the area can also influence insurance costs.

- Homes in high-risk areas may have higher premiums.

- Proximity to a fire station can lower insurance costs.

- Crime rates in the area can impact insurance premiums.

Ways to Lower Insurance Premiums

There are several ways homeowners can potentially lower their insurance premiums. Installing safety features such as smoke detectors, security systems, and impact-resistant roofing can reduce the risk of damage and may lead to premium discounts. Additionally, bundling home and auto insurance policies with the same provider or increasing the deductible amount can also help lower premiums.

- Install safety features like smoke detectors and security systems.

- Consider impact-resistant roofing to reduce the risk of damage.

- Bundle home and auto insurance policies for potential discounts.

- Increase the deductible amount to lower premiums.

Home Features Impacting Insurance Costs

Certain home features can affect insurance costs. For example, homes with swimming pools, trampolines, or outdated electrical systems may have higher premiums due to increased liability risks. On the other hand, features like a new roof, updated plumbing, or a home security system can potentially lower insurance costs.

- Homes with swimming pools or trampolines may have higher premiums.

- Outdated electrical systems can increase liability risks and insurance costs.

- New roof, updated plumbing, and home security systems can lower insurance premiums.

Understanding Coverage Options

When it comes to homeowners insurance, understanding the coverage options available is crucial to ensure your property and belongings are adequately protected. Let's delve into the details of different coverage options to help you make informed decisions.

Actual Cash Value vs. Replacement Cost Coverage

When you have actual cash value coverage, your insurance provider will reimburse you for the depreciated value of your property or belongings at the time of the loss. On the other hand, replacement cost coverage will pay for the actual cost of replacing the damaged or lost item without considering depreciation.

Standard Homeowners Insurance Policy Coverage

- Your standard homeowners insurance policy typically covers the structure of your home, personal belongings, liability protection, and additional living expenses in case you cannot stay in your home due to a covered loss.

- It's essential to review your policy to understand the specific limits and exclusions that may apply to your coverage.

Additional Coverage Options

Aside from the standard coverage, you may want to consider additional options like:

- Flood Insurance:Protects your home and belongings from flood damage, which is not covered under a standard policy.

- Earthquake Insurance:Covers damages caused by earthquakes, which are typically excluded from standard policies.

- Personal Property Endorsements:Allows you to increase coverage limits for high-value items like jewelry, art, or collectibles.

Importance of Reading Policy Exclusions

It's crucial to carefully read and understand the policy exclusions to know what is not covered by your insurance. Common exclusions may include damages from certain natural disasters, acts of war, or intentional acts. Knowing these exclusions can help you assess your risk exposure and consider supplemental coverage if needed.

Filing Claims and the Claims Process

When it comes to homeowners insurance, understanding the process of filing claims is essential. Knowing how to navigate the claims process effectively can make a significant difference in getting the help you need when faced with unexpected damage or loss.

Steps in Filing a Homeowners Insurance Claim

- Notify Your Insurance Company: Contact your insurance company as soon as possible to report the damage or loss.

- Document the Damage: Take photos or videos of the damage to provide visual evidence.

- Work with Adjusters: An insurance adjuster will assess the damage and determine the coverage.

- Receive Claim Payment: Once the claim is approved, you will receive a payment to cover the damages.

Tips for Homeowners in Navigating the Claims Process

- Understand Your Policy: Familiarize yourself with your policy coverage to know what is included.

- Keep Records: Maintain records of communication, receipts, and documentation related to the claim.

- Be Prompt: Report the damage promptly and respond promptly to any requests from the insurance company.

Common Reasons for Homeowners Insurance Claim Denials

- Policy Exclusions: Damage caused by events not covered in your policy may lead to a claim denial.

- Insufficient Documentation: Inadequate proof of damage or loss can result in a denied claim.

- Delayed Reporting: Failing to report the damage in a timely manner can impact the outcome of your claim.

Last Word

In conclusion, homeowners insurance is not just a safety net for your home, but also a shield against unforeseen circumstances. By understanding the coverage options, factors affecting premiums, and the claims process, you can make informed decisions to protect your most valuable asset.

Stay informed, stay protected.

Helpful Answers

What does homeowners insurance typically cover?

Homeowners insurance typically covers damages to your home, personal belongings, liability protection, and additional living expenses in case your home becomes uninhabitable.

How can I lower my homeowners insurance premiums?

You can potentially lower your premiums by increasing your deductible, bundling your insurance policies, improving home security measures, and maintaining a good credit score.

Is flood insurance included in a standard homeowners insurance policy?

Flood insurance is usually not included in a standard policy and requires a separate policy, especially if you live in a flood-prone area.

What is the difference between actual cash value and replacement cost coverage?

Actual cash value coverage reimburses you for the depreciated value of your damaged property, while replacement cost coverage pays for the cost of replacing the damaged items with new ones.

Can I file a claim for any type of damage to my home?

You can file a claim for damages covered in your policy, but it's important to review your policy to understand what is and isn't covered to avoid claim denials.