Unveiling the Secrets of Cheap Full Coverage Car Insurance

Embark on a journey through the realm of cheap full coverage car insurance, where we unravel the mysteries behind affordable yet comprehensive auto insurance.

Delve into the intricacies of what constitutes cheap full coverage, exploring its components and significance in the world of insurance.

Understanding Cheap Full Coverage Car Insurance

When we talk about "cheap full coverage car insurance," we are referring to a type of auto insurance policy that provides extensive protection for your vehicle at an affordable rate. This type of insurance typically includes coverage for damage to your car as well as liability protection.

Components of Full Coverage Car Insurance

Full coverage car insurance usually consists of three main components:

- Collision coverage: This helps pay for repairs to your car if you are involved in a collision with another vehicle or object.

- Comprehensive coverage: This covers damage to your car from non-collision incidents such as theft, vandalism, or natural disasters.

- Liability coverage: This protects you if you are at fault in an accident and covers the other party's medical expenses or property damage.

Importance of Having Full Coverage Car Insurance

Having full coverage car insurance is crucial for several reasons:

- Protection against financial loss: Full coverage insurance helps safeguard you financially in case of an accident or unexpected event that damages your vehicle.

- Peace of mind: Knowing that you have comprehensive coverage can give you peace of mind while driving, knowing that you are protected in various situations.

- Legal requirements: In many states, having liability insurance is mandatory, and full coverage often includes this essential component.

Factors Influencing Cheap Full Coverage Car Insurance Rates

When it comes to determining the cost of full coverage car insurance, there are several factors that insurance companies take into consideration. Understanding these factors can help you make informed decisions to potentially lower your insurance rates.Age, Driving Record, Location, and Type of Vehicle:Age, driving record, location, and the type of vehicle you drive can all have a significant impact on your car insurance rates.

Younger drivers and those with a history of accidents or traffic violations may be considered higher risk, resulting in higher premiums. Additionally, where you live can also affect your rates, with urban areas typically having higher rates due to increased traffic and crime rates.

The type of vehicle you drive, including the make, model, and age, can also influence your rates.Bundling Policies and Increasing Deductibles:One way to potentially lower your full coverage car insurance rates is by bundling multiple insurance policies with the same provider.

This can often lead to discounts on your premiums. Another option is to increase your deductibles, which is the amount you pay out of pocket before your insurance coverage kicks in. While increasing your deductibles can lower your premiums, it's important to ensure you can afford the higher out-of-pocket costs in the event of an accident.

Age and Insurance Rates

Age is a significant factor that insurance companies consider when calculating your car insurance rates. Younger drivers, especially those under 25, are often charged higher premiums due to their perceived higher risk of accidents. As you get older and gain more driving experience, you may see a decrease in your insurance rates.

Driving Record and Insurance Rates

Your driving record plays a crucial role in determining your car insurance rates. If you have a history of accidents, traffic violations, or DUIs, you may be considered a high-risk driver, leading to higher premiums. On the other hand, a clean driving record with no incidents can help you secure lower insurance rates.

Location and Insurance Rates

Where you live can also impact your car insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. Additionally, states with higher rates of uninsured drivers may also result in higher insurance costs for all drivers in that area.

Type of Vehicle and Insurance Rates

The type of vehicle you drive can affect your insurance rates. Sports cars and luxury vehicles typically come with higher premiums due to their higher repair costs and increased risk of theft. On the other hand, safe and reliable vehicles with advanced safety features may qualify for discounts on insurance premiums

Finding Affordable Full Coverage Car Insurance

When it comes to finding affordable full coverage car insurance, there are a few strategies you can use to secure the best rates without compromising on coverage. Comparing quotes from different insurance providers, reviewing coverage limits, and deductibles are essential steps to take in order to find the most affordable option that meets your needs.

Comparing Quotes from Different Insurance Providers

- Start by obtaining quotes from multiple insurance companies to compare rates.

- Consider using online comparison tools to streamline the process and get a comprehensive view of available options.

- Look for discounts or special offers that may be available from different providers.

Reviewing Coverage Limits and Deductibles

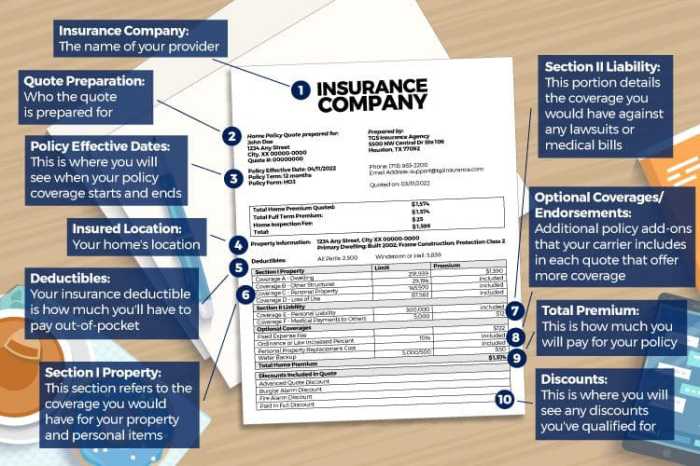

- Understand the coverage limits and deductibles offered by each insurance provider.

- Choose coverage limits that align with your needs and budget, while ensuring you have adequate protection.

- Consider adjusting deductibles to lower your premium, but be prepared to pay more out of pocket in the event of a claim.

Benefits of Cheap Full Coverage Car Insurance

Having cheap full coverage car insurance comes with several advantages that can provide peace of mind and financial protection in case of unexpected events.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, natural disasters, and falling objects. This means that you can repair or replace your car without bearing the full financial burden.

Collision Coverage

Collision coverage safeguards you in the event of an accident, whether it involves another vehicle or an object. This coverage helps cover repair costs for your car, even if you are at fault, reducing out-of-pocket expenses.

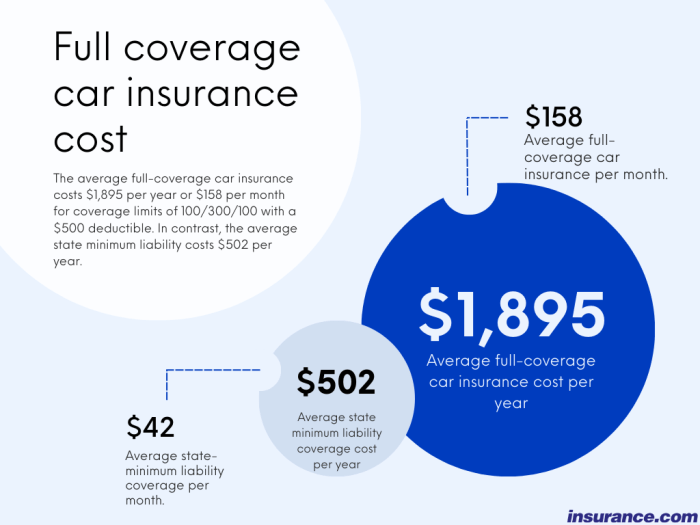

Saving Money in the Long Run

While full coverage car insurance may have a higher premium than basic liability insurance, it can save you money in the long run. With comprehensive and collision coverage, you can avoid significant expenses associated with repairing or replacing your vehicle out of pocket in case of an accident or other covered event.

Summary

In conclusion, cheap full coverage car insurance offers a blend of affordability and extensive protection, making it a crucial aspect of responsible vehicle ownership.

FAQ Corner

What exactly is cheap full coverage car insurance?

Cheap full coverage car insurance provides comprehensive protection for your vehicle at a budget-friendly price, covering a wide range of risks.

How can I find the most affordable full coverage car insurance?

To find affordable full coverage car insurance, compare quotes from different providers, consider bundling policies, and review coverage limits and deductibles.

What are the benefits of opting for cheap full coverage car insurance?

Having cheap full coverage car insurance ensures you are safeguarded against various risks, such as accidents and theft, ultimately saving you money in the long run.