Unveiling the Best Full Coverage Car Insurance Options

Diving into the realm of full coverage car insurance, this introduction sets the stage for a comprehensive exploration of the topic. Providing insights into the intricacies of full coverage policies, this piece aims to equip readers with valuable knowledge to make informed decisions.

Exploring the various types of coverage, factors influencing choices, and cost considerations, this discussion delves deep into the world of full coverage car insurance.

What is Full Coverage Car Insurance?

Full coverage car insurance is a comprehensive auto insurance policy that provides a wide range of coverage options to protect you, your vehicle, and others in the event of an accident or other unforeseen circumstances.

Types of Coverage Included in Full Coverage Policies

Full coverage car insurance typically includes the following types of coverage:

- Liability coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision coverage: This pays for damage to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive coverage: This covers damage to your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you're in an accident with a driver who doesn't have insurance or enough insurance to cover your damages.

Benefits of Full Coverage Insurance

Full coverage car insurance can be beneficial in various situations, such as:

- Protecting your vehicle: Full coverage provides comprehensive protection for your vehicle, ensuring that you can repair or replace it in case of damage.

- Financial security: With full coverage, you can have peace of mind knowing that you are financially protected in various scenarios, reducing the risk of unexpected expenses.

- Legal requirements: In some states, full coverage insurance is required by law, making it essential for compliance with regulations and avoiding penalties.

Factors to Consider When Choosing Full Coverage Car Insurance

When choosing a full coverage car insurance policy, there are several important factors to consider to ensure you are getting the right coverage for your needs and budget.

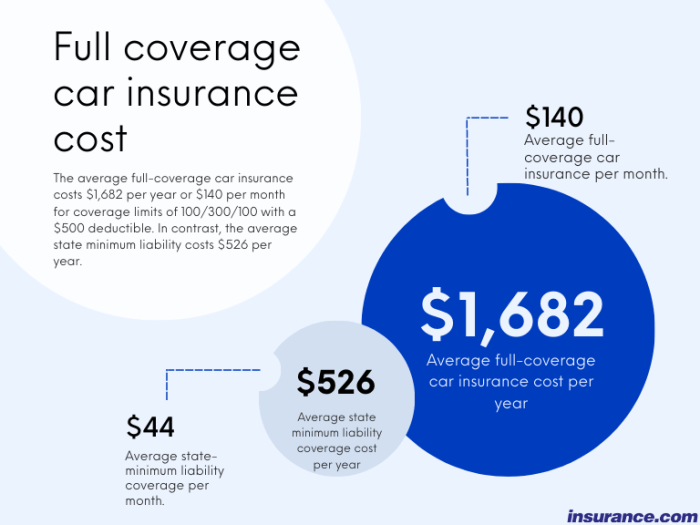

- Cost of Premiums: Full coverage car insurance typically comes with higher premiums compared to basic or liability coverage. It is essential to assess your budget and determine if the higher cost is feasible for you.

- Level of Coverage: Full coverage insurance includes comprehensive and collision coverage in addition to liability insurance. Consider the value of your vehicle and how much coverage you need to protect your investment.

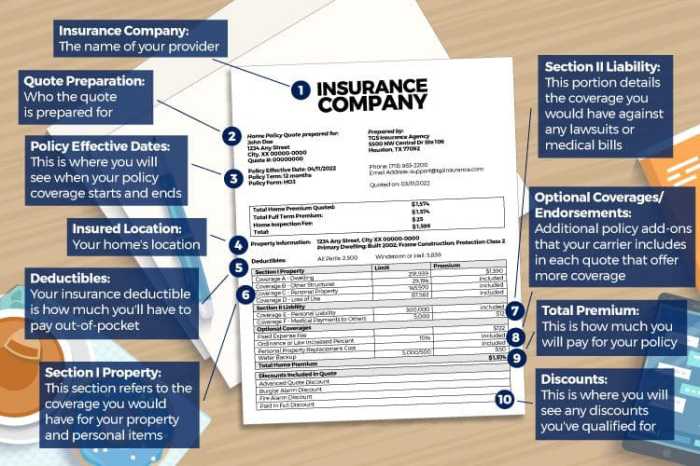

- Deductibles: Evaluate the deductibles associated with full coverage insurance. Higher deductibles can lower your premiums but will require you to pay more out of pocket in the event of a claim.

- Driving Habits: Your driving habits can impact the type of coverage you need. If you have a long commute or frequently drive in high-traffic areas, you may want more comprehensive coverage.

- Type of Vehicle: The type of vehicle you drive can also influence your insurance needs. Newer or more expensive cars may benefit from full coverage to protect against potential damages.

Understanding the Cost of Full Coverage Car Insurance

When it comes to full coverage car insurance, understanding the cost is crucial. The price of full coverage insurance can vary based on several factors that influence the overall premium. By delving into the components that contribute to the cost of full coverage car insurance, individuals can gain insights on how to potentially lower their premiums and manage their expenses effectively.

Components Influencing Full Coverage Car Insurance Costs

- The type of coverage included in the policy, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage.

- The make and model of the vehicle, as well as its age, value, and safety features.

- The driver's age, driving record, and credit score, which can impact the risk assessment by insurance providers.

- The location where the vehicle is primarily driven and parked, including factors like crime rates and traffic congestion.

- The deductible amount chosen by the policyholder, as it directly affects the premium cost.

Tips to Lower Full Coverage Car Insurance Premiums

- Compare quotes from multiple insurance providers to find the best rate for the desired coverage.

- Bundle auto insurance with other policies, such as home or renters insurance, to potentially qualify for discounts.

- Opt for a higher deductible amount if financially feasible, as it can lower the premium cost.

- Maintain a clean driving record and participate in defensive driving courses to demonstrate safe driving habits.

- Consider reducing coverage on older vehicles with lower values to decrease insurance costs.

Relationship Between Deductibles and Premium Costs

- Increasing the deductible amount typically leads to lower premium costs, as the policyholder agrees to pay a higher amount out of pocket in the event of a claim.

- Conversely, choosing a lower deductible results in higher premium costs, as the insurance provider assumes more financial risk in case of a claim.

- It's essential to strike a balance between the deductible amount and premium cost based on individual financial circumstances and risk tolerance.

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers several advantages over basic coverage, providing policyholders with comprehensive financial protection in various scenarios.

1. Enhanced Financial Protection

- Full coverage insurance includes both collision and comprehensive coverage, protecting your vehicle against damage from accidents, theft, vandalism, and natural disasters.

- In the event of an accident, full coverage insurance can help cover the cost of repairing or replacing your vehicle, reducing the financial burden on you.

2. Medical Expenses Coverage

- Full coverage insurance typically includes coverage for medical expenses resulting from a car accident, such as hospital bills, rehabilitation costs, and lost wages.

- This coverage can provide crucial financial support in case you or your passengers sustain injuries in an accident.

3. Protection Against Uninsured Drivers

- Full coverage insurance often includes uninsured/underinsured motorist coverage, which safeguards you in case you are involved in an accident with a driver who lacks insurance or sufficient coverage.

- This coverage can help cover your medical expenses and vehicle repairs if the at-fault driver is unable to pay.

4. Peace of Mind

- Having full coverage insurance can offer peace of mind knowing that you are financially protected in a wide range of scenarios, including accidents, theft, and natural disasters.

- It can alleviate stress and worry associated with potential costly repairs or medical bills, allowing you to drive with confidence.

Final Review

In conclusion, full coverage car insurance emerges as a crucial shield against unforeseen circumstances on the road. By understanding its benefits, costs, and components, individuals can navigate the insurance landscape with confidence and security.

FAQ Section

What does full coverage car insurance entail?

Full coverage car insurance typically includes collision, comprehensive, and liability coverage, offering extensive protection for various scenarios.

How can I lower the cost of full coverage premiums?

Individuals can reduce their full coverage premiums by maintaining a clean driving record, opting for a higher deductible, and bundling policies.

When is full coverage insurance particularly beneficial?

Full coverage insurance shines in situations involving expensive repairs, theft, natural disasters, and accidents where the policyholder is at fault.