Crafting the Right Small Business Insurance Strategy

Embark on a journey through the world of small business insurance, where protection meets innovation to safeguard your business endeavors. From understanding the importance of insurance to navigating the various coverage options, this guide is your compass in the realm of risk management.

Delve deeper into the intricacies of small business insurance and discover how a well-tailored policy can serve as a shield against unforeseen challenges.

Importance of Small Business Insurance

Small business insurance is crucial for protecting a business from unforeseen circumstances and potential financial losses. By having the right insurance coverage in place, small business owners can safeguard their assets and ensure the continuity of their operations in case of unexpected events.

Risks Mitigated by Small Business Insurance

- Property Damage: Insurance can help cover the costs of repairing or replacing damaged property due to fire, theft, or natural disasters.

- Liability Claims: In case of lawsuits or claims against your business for injuries or damage caused to others, insurance can cover legal fees and settlements.

- Business Interruption: If your business operations are disrupted due to unforeseen events, insurance can provide financial support to help you recover and resume operations.

Peace of Mind for Small Business Owners

Having insurance coverage offers peace of mind to small business owners, knowing that they are protected against various risks that could potentially threaten their business. This security allows them to focus on running and growing their business without constantly worrying about the what-ifs.

Types of Small Business Insurance

When it comes to protecting your small business, having the right insurance coverage is crucial. There are several types of insurance policies available, each offering different types of protection. Let's take a look at some of the most common types of small business insurance and the coverage they provide.

General Liability Insurance

General liability insurance is essential for small businesses as it provides coverage for claims of bodily injury, property damage, and personal injury. This type of insurance can help cover legal fees, medical expenses, and settlements in case a customer or third party sues your business for damages.

Property Insurance

Property insurance is designed to protect your business property, including buildings, equipment, inventory, and furniture, from risks such as fire, theft, vandalism, and natural disasters. This coverage can help you repair or replace damaged property, ensuring your business can continue operating smoothly.

Workers’ Compensation Insurance

Workers' compensation insurance is mandatory in most states and provides benefits to employees who are injured or become ill while on the job. This insurance covers medical expenses, lost wages, and rehabilitation costs for employees, reducing the financial burden on your business in case of workplace injuries.

Commercial Auto Insurance

If your business uses vehicles for operations, commercial auto insurance is essential. This type of insurance provides coverage for vehicles used for business purposes, including accidents, theft, and damage. It can help cover repair costs, medical expenses, and legal fees in case of a car accident involving your business vehicle.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects your business from claims of negligence, errors, or omissions in the services you provide. This coverage is crucial for professions such as consultants, lawyers, and healthcare providers, helping cover legal expenses and damages resulting from professional mistakes.

Cyber Liability Insurance

In today's digital age, cyber liability insurance is becoming increasingly important for small businesses. This insurance provides coverage for data breaches, cyberattacks, and other cyber threats that can compromise sensitive information. It can help cover expenses related to data recovery, notification costs, and legal fees in case of a cyber incident.

Cost Factors and Considerations

When it comes to small business insurance, the cost can vary depending on several factors. Understanding these factors and knowing how to manage them can help small business owners make informed decisions and save money while ensuring adequate coverage

Factors Influencing Insurance Costs

- Industry: The type of business you operate can significantly impact your insurance costs. Industries with higher risk factors, such as construction or healthcare, may have higher premiums.

- Coverage Limits: The amount of coverage you choose will also affect your insurance costs. Higher coverage limits mean higher premiums.

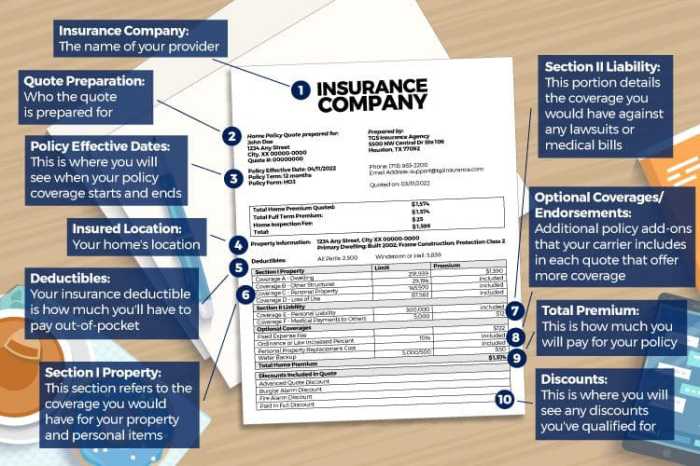

- Deductible: The deductible is the amount you must pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums, but it also means you'll have to pay more in case of a claim.

Tips to Reduce Insurance Costs

- Shop Around: Compare quotes from different insurance providers to find the best rates for your specific needs.

- Bundle Policies: Consider bundling multiple types of insurance, such as general liability and property insurance, with the same provider for potential discounts.

- Implement Safety Measures: Taking steps to reduce risks in your business, such as improving workplace safety or security, can help lower your insurance premiums.

- Review and Update Policies: Regularly review your insurance policies to ensure they still meet your business needs. Adjust coverage limits and deductibles as necessary to optimize costs.

Choosing the Right Insurance Provider

When it comes to selecting an insurance provider for your small business, there are several key factors to consider to ensure you are getting the best coverage for your needs. It's important to compare different insurance companies in terms of their reputation, customer service, and coverage options to make an informed decision.

Reputation

When choosing an insurance provider for your small business, it's essential to consider the reputation of the company. Look for reviews and ratings from other small business owners to get an idea of the quality of service the insurance provider offers.

A company with a good reputation is more likely to provide reliable coverage and customer support.

Customer Service

Customer service is another crucial factor to consider when selecting an insurance provider. You want to choose a company that is responsive, helpful, and easy to reach in case you need to file a claim or have any questions about your policy.

Good customer service can make a significant difference in your overall experience with an insurance provider.

Coverage Options

Evaluate the coverage options offered by different insurance providers to ensure they meet your specific needs as a small business owner. Consider the types of insurance policies available, such as general liability, property insurance, or professional liability coverage. Make sure the policy details align with the risks your business faces to ensure adequate protection.

Summary

As we conclude our exploration of small business insurance, remember that preparedness is the key to resilience in the face of uncertainty. By securing the right insurance coverage, you pave the way for sustainable growth and peace of mind in your entrepreneurial journey.

Top FAQs

What factors determine the cost of small business insurance?

The cost of small business insurance is influenced by various factors, including the industry type, coverage limits, and deductible amounts. Insurers analyze these factors to calculate premiums tailored to the specific risk profile of each business.

How can small business owners reduce insurance costs?

Small business owners can explore options such as bundling policies, implementing risk management strategies, and comparing quotes from multiple insurers to find competitive rates without compromising coverage quality.

Why is it important to review and update insurance policies regularly?

Regularly reviewing and updating insurance policies ensures that coverage aligns with the evolving needs and risks of your business. This proactive approach helps prevent gaps in coverage and ensures adequate protection against potential liabilities.